Check your contract language thoroughly to see what hazards are particularly covered (or not covered), in addition to what your insurance will pay to replace or fix. House insurance coverage usually uses a level of liability security. If someone falls and injures themselves in your driveway, for instance, the policy can pay if you were to be sued. Like a lot of sort of insurance, the expense will differ. Elements that identify your total expense for premiums consist of just how much your timeshare vacation promotions house deserves, any outdoors structures, how you use your residential or commercial property and the overall value of your belongings. The last cost can be hundreds approximately countless dollars yearly, depending on how low you desire your deductible and whether you cover the full replacement cost of the house and its contents.

You desire a policy that suffices to change the structure and contents of your house if it's damaged or damaged. Policyholders expect to have momentary accommodations while a brand-new living arrangement is being prepared. A leading policy will include excellent customer service and make the claims process simple. The cost of house insurance coverage is really tailored and follows a formula based on a range of aspects. What may be the least expensive business in one area may not be as budget-friendly in another part of the country. Your home type, such as single-family versus apartment, might modify the pricing, as well.

To get the very best rate on a policy, search with several business. There are numerous ways to keep homeowners insurance coverage costs down. Here are a few typical methods: Raise your deductible to protect a lower rate. Pay your premiums in advance, instead of through monthly payments. Package with your auto or life insurance. Improve your credit. Make enhancements to the security and security of your house, such as including extra fire avoidance or home security technology. (Not all policies will reduce your rate for these improvements, though.) Going numerous years without filing a claim can have a long-term, positive impact on your rates.

Finding out how much insurance coverage you need starts with calculating the replacement value of your house, or a comparable home if it needed to be reconstructed today. Then, include the cost to change your ownerships, including any prized possessions or items that might not be easily bought. Lastly, think about the expense of an average liability claimit might be much greater than the $100,000 limitation in a lot of standard policies. Seek advice from with your insurance representative or company to see how these factors can be combined into a comprehensive house policy that protects your interests. A few of the leading house insurance provider in the U.S., according to Bankrate, are: Amica Mutual Allstate Metlife Geico Farmers Standard home insurance does not usually cover flooding, either from natural occasions or from structural failure.

Like other policies, flood insurance coverage does not cover pre-existing water damage or a flood that's already in development at the time the client buys the policy. Tenants insurance is a group of protections http://keeganbner939.over-blog.com/2021/05/what-does-what-is-an-insurance-premium-mean.html bundled into one policy that can safeguard occupants from unanticipated damage or loss. It covers their property, their usage of the property and liability that others might look for versus them. Here are Bankrate's choices for the finest tenants insurance provider. While the policy rate will differ by client and type of property covered, tenants insurance is inexpensive. Average regular monthly premiums range from $15 to $30 a month.

The Only Guide for How Much Life Insurance Do I Need

Occupants insurance also offers some liability protection, protecting you against claims if someone is harmed in your rented house. A good tenants insurance coverage policy will also safeguard other individuals's residential or commercial property from damage the happened in your home, in addition to the expense for you to live elsewhere while your house is restored after an event.

Insurance coverage is something many people don't even wish to think of till they need it one of the most. However, understanding what is and isn't covered in your property owners insurance policy can suggest the difference of having the ability to rebuild your house and replace your individual possessions. Property owners require to do yearly insurance coverage "check ups" to make sure they keep up with regional building costs, home renovation and inventories of their individual possessions. The common house owners insurance coverage covers damage arising from fire, windstorm, hail, water damage (omitting flooding), riots and surge as well as other causes of loss, such as theft and the additional cost of living in other places which the structure is being repaired or reconstructed.

Click here for additional information on basic liability protection and umbrella policies. The Structure of Your House Replacement Expense. Insurance coverage that pays the insurance policy holder the cost of replacing the damaged property without deduction for depreciation, but limited to an optimal dollar amount. Extended Replacement Expense. An extended replacement cost policy, one that covers expenses approximately a certain portion over the limitation (generally 20%). This offers you protection versus such things as a sudden increase in building costs. Real Cash Worth. This covers the expense to replace your house minus devaluation costs for age and usage. For example, if the life expectancy of your roofing is twenty years and your roofing is 15 years old, the cost to change it in today's marketplace is going to be much greater than its actual cash value.

That's not the Helpful site marketplace worth, but the cost to rebuild. If you don't have adequate insurance coverage, your company might only pay a portion of the expense of changing or fixing damaged items. Here are some pointers to assist make certain you have sufficient insurance coverage: For a quick price quote on the quantity to rebuild your home: multiply the regional structure costs per square foot by the overall square footage of your home. To discover out the structure rates in your location, consult your regional builders association or a trusted home builder. You need to likewise contact your insurance representative or business representative.

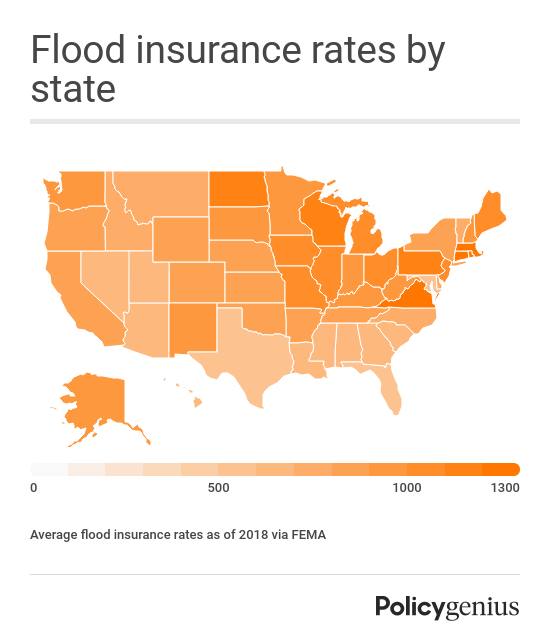

Aspects that will determine the cost to reconstruct your house: a) building costs b) square footage of the structure c) type of exterior wall constructionframe, masonry or veneer d) the style of your home (cattle ranch, colonial) e) the number of rooms & restrooms f) the kind of roofing g) connected garages, fireplaces, exterior trim and other unique features like arched windows or unique interior trim. Examine the value of your insurance coverage against rising local structure cost EACH YEAR. Talk to your insurance coverage representative or company agent if they use an "INFLATION GUARD CLAUSE. How much is flood insurance." This automatically changes the home limitation when you restore your policy to reflect present building expenses in your area.

A Biased View of How To Buy Health Insurance

Examine the current structure codes in your community. Building regulations require structures to be constructed to minimum standards. If your house is seriously damaged, you may need to rebuild it to comply with the new requirements needing a change in design or building products. These normally cost more. Do not guarantee your home for the marketplace worth. The expense of reconstructing your home may be higher or lower than the rate you paid for it or the cost you might sell it for today. A lot of loan providers require you to purchase sufficient insurance coverage to cover the amount of your home mortgage. Make certain it's also enough to cover the cost of restoring.